DESCRIPTION OF THE REGISTRANT’S SECURITIES REGISTERED PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

The following is a description of the capital stock of Innovid Corp. (“Innovid,” the “Company,” “we,” “us,” or “our”) and certain provisions of our amended and restated certificate of incorporation (the “Certificate of Incorporation”), our bylaws (the “Bylaws”) and the General Corporation Law of the State of Delaware (the “DGCL”), as well as the terms of our Warrants (as defined below). This description is summarized from, and qualified in its entirety by reference to, our certificate of incorporation and bylaws, the warrant agreement, dated as of February 10, 2021 (the “Warrant Agreement”), by and between ION Acquisition Corp 2 Ltd. and Continental Stock Transfer & Trust Company, and the applicable provisions of the DGCL. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), of which this Exhibit 4.4 is a part.

Our certificate of incorporation authorizes capital stock consisting of:

•500,000,000 shares of Common Stock, par value $0.0001 per share (“Common Stock”); and

•500,000 shares of preferred stock, par value $0.0001 per share.

Common Stock

Voting Rights

Each holder of our common stock is entitled to one vote for each share of our common stock held of record by such holder on all matters on which stockholders generally are entitled to vote. The holders of our common stock do not have cumulative voting rights in the election of directors. Generally, unless otherwise specified by law, the listing requirements of the NYSE, our bylaws or our certificate of incorporation, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all stockholders present in person or represented by proxy, voting together as a single class.

Dividend Rights

Subject to preferences that may be applicable to any outstanding preferred stock, the holders of shares of our common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by the Board of Directors (the “Board”) out of funds legally available for such purposes.

Liquidation, Dissolution and Winding Up

In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company’s affairs, the holders of our common stock are entitled to share ratably in all assets remaining after payment of the Company’s debts and other liabilities, subject to prior distribution rights of our preferred stock or any class or series of stock having a preference over our common stock, then outstanding, if any.

Other Rights

The holders of our common stock have no pre-emptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of holders of our common stock will be subject to those of the holders of any shares of our preferred stock may issue in the future.

Preferred Stock

The Certificate of Incorporation authorizes the Board to establish one or more series of preferred stock. Unless required by law or any stock exchange, the authorized shares of preferred stock will be available for issuance without further action by the holders of our common stock. The Board has the discretion to determine the powers, preferences and relative, participating, optional and other special rights, including voting rights, dividend rights, conversion rights, Redemption privileges and liquidation preferences, of each series of preferred stock. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of the Company without further action by the stockholders. Additionally, the issuance of preferred stock may adversely affect the

holders of our common stock by restricting dividends on our common stock, diluting the voting power of our common stock or subordinating the liquidation rights of our common stock. As a result of these or other factors, the issuance of preferred stock could have an adverse impact on the market price of our common stock. At present, we have no plans to issue any preferred stock.

Warrants

Public Warrants

Each whole warrant entitles the registered holder to purchase one share of common stock of the Company at a price of $11.50 per share, subject to adjustment as discussed below, provided that we have an effective registration statement under the Securities Act covering the shares issuable upon exercise of the warrants and a current prospectus relating to them is available (or we permit holders to exercise their warrants on a cashless basis under the circumstances specified in the applicable Warrant Agreement) and such shares are registered, qualified or exempt from registration under the securities, or blue sky, laws of the state of residence of the holder. Pursuant to the Warrant Agreement, a warrant holder may exercise its warrants only for a whole number of shares of common stock of the Company. This means only a whole warrant may be exercised at a given time by a warrant holder. The warrants will expire five years after November 30, 2021, at 5:00 p.m., New York City time, or earlier upon redemption or liquidation.

We will not be obligated to deliver any common shares pursuant to the exercise of a warrant and will have no obligation to settle such warrant exercise unless a registration statement under the Securities Act with respect to the common shares underlying the warrants is then effective and a prospectus relating thereto is current, subject to our satisfying our obligations described below with respect to registration. No warrant will be exercisable and we will not be obligated to issue a common share of the Company upon exercise of a warrant unless the common share issuable upon such warrant exercise has been registered, qualified or deemed to be exempt under the securities laws of the state of residence of the registered holder of the warrants. In the event that the conditions in the two immediately preceding sentences are not satisfied with respect to a warrant, the holder of such warrant will not be entitled to exercise such warrant and such warrant may have no value and expire worthless. In no event will we be required to net cash settle any warrant.

During any period when we will have failed to maintain an effective registration statement, exercise warrants on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act or another exemption.

Notwithstanding the above, if our common shares are at the time of any exercise of a warrant not listed on a national securities exchange such that they satisfy the definition of a “covered security” under Section 18(b)(1) of the Securities Act, we may, at our option, require holders of public warrants who exercise their warrants to do so on a “cashless basis” in accordance with Section 3(a)(9) of the Securities Act and, in the event we so elect, we will not be required to file or maintain in effect a registration statement, and in the event we do not so elect, we will use our commercially reasonable efforts to register or qualify the shares under applicable blue sky laws to the extent an exemption is not available.

Redemption of warrants when the price per common share equals or exceeds $18.00.

We may redeem the outstanding warrants (except as described herein with respect to the private placement warrants):

•in whole and not in part;

•at a price of $0.01 per warrant;

•upon a minimum of 30 days’ prior written notice of redemption (the “30-day redemption period”); and

•if, and only if, the closing price of the Company’s common shares equals or exceeds $18.00 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant) for any 20 trading days within a 30-trading day period ending three business days before we send the notice of redemption to the warrant holders.

If and when the warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws.

We have established the last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant premium to the warrant exercise price. If the foregoing conditions are satisfied and we issue a notice of redemption of the warrants, each warrant holder will be entitled to exercise his, her or its warrant prior to the scheduled redemption date. However, the price of the Company’s common shares may fall below the $18.00 redemption trigger price (as adjusted for share sub-divisions, share capitalizations, reorganizations, recapitalizations and the like) as well as the $11.50 warrant exercise price after the redemption notice is issued.

Redemption of warrants when the price per common share equals or exceeds $10.00.

We may redeem the outstanding warrants (except as described herein with respect to the private placement warrants):

•in whole and not in part;

•at a price of $0.10 per warrant;

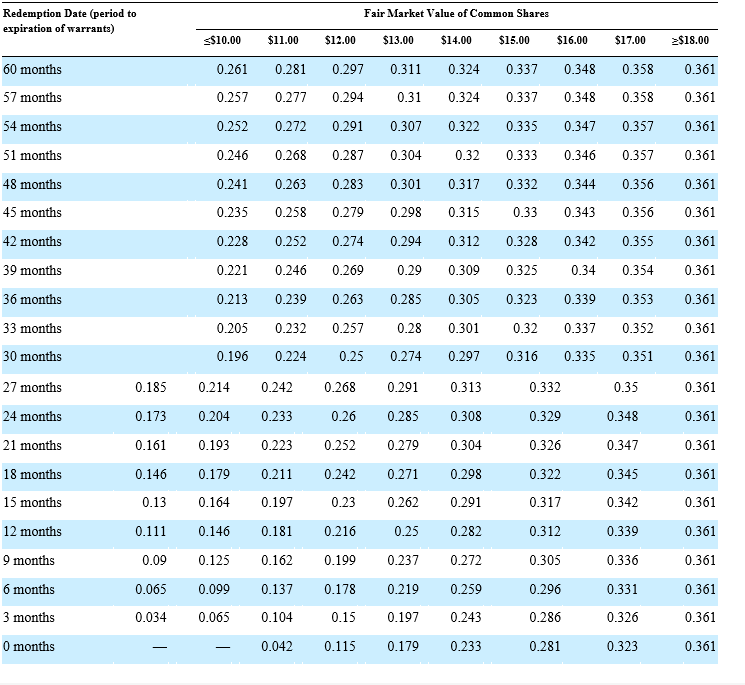

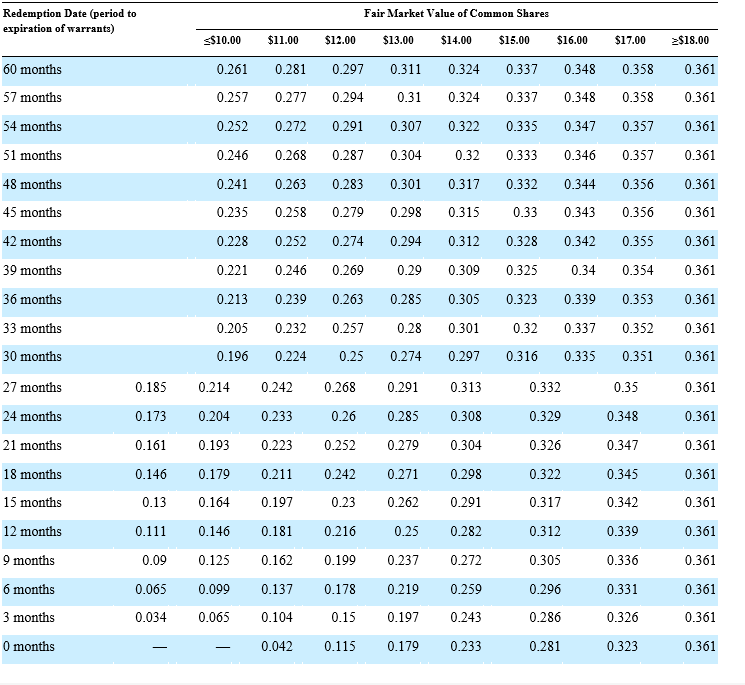

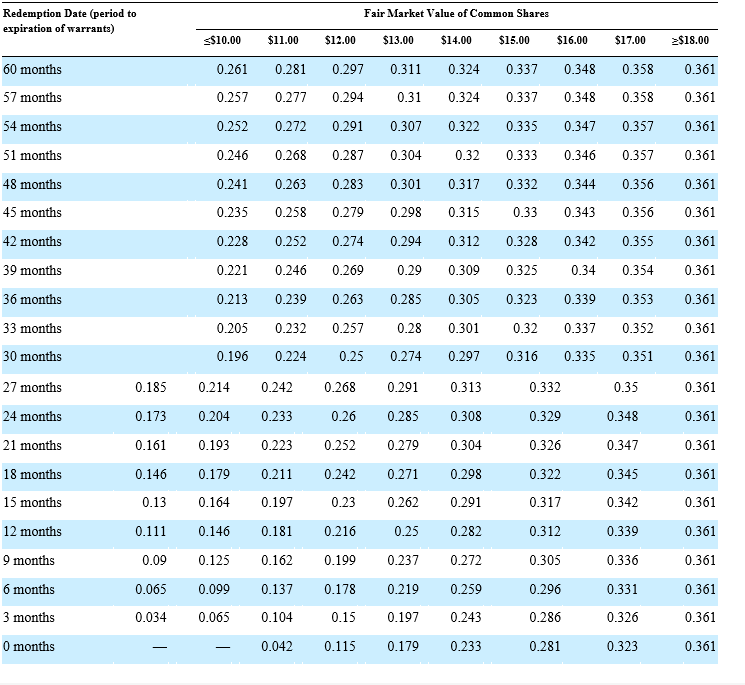

•upon a minimum of 30 days’ prior written notice of redemption, provided that holders will be able to exercise their warrants on a cashless basis prior to redemption and receive that number of shares determined by reference to the table below, based on the redemption date and the “fair market value” (as defined below) of our common shares except as otherwise described below; and

•if, and only if, the closing price of our common shares equals or exceeds $10.00 per share (as adjusted for adjustments to the number of shares issuable upon exercise or the exercise price of a warrant) for any 20 trading days within the 30-trading day period ending three business days before we send the notice of redemption to the warrant holders.

Beginning on the date the notice of redemption is given and until the warrants are redeemed or exercised, holders may elect to exercise their warrants on a cashless basis. The numbers in the table below represent the number of common shares that a warrant holder will receive upon such cashless exercise in connection with a redemption by us pursuant to this redemption feature, based on the “fair market value” of our common shares on the corresponding redemption date (assuming holders elect to exercise their warrants and such warrants are not redeemed for $0.10 per warrant), determined for these purposes based on the volume-weighted average price of our common shares during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of warrants, and the number of months that the corresponding redemption date precedes the expiration date of the warrants, each as set forth in the table below. We will provide our warrant holders with the final fair market value no later than one business day after the 10-trading day period described above ends.

The share prices set forth in the column headings of the table below will be adjusted as of any date on which the number of shares issuable upon exercise of a warrant or the exercise price of a warrant is adjusted as set forth under the heading “Anti-dilution Adjustments” below. If the number of shares issuable upon exercise of a warrant is adjusted, the adjusted share prices in the column headings will equal the share prices immediately prior to such adjustment, multiplied by a fraction, the numerator of which is the number of shares deliverable upon exercise of a warrant immediately prior to such adjustment and the denominator of which is the number of shares deliverable upon exercise of a warrant as so adjusted. The number of shares in the table below shall be adjusted in the same manner and at the same time as the number of shares issuable upon exercise of a warrant. If the exercise price of a warrant is adjusted, (a) in the case of an adjustment pursuant to the fifth paragraph under the heading “Anti-dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share prices multiplied by a fraction, the numerator of which is the higher of the Market Value and the Newly Issued Price as set forth under the heading “Anti-dilution Adjustments” and the denominator of which is $10.00 and (b) in the case of an adjustment pursuant to the second paragraph under the heading “Anti-dilution Adjustments” below, the adjusted share prices in the column headings will equal the unadjusted share prices less the decrease in the exercise price of a warrant pursuant to such exercise price adjustment.

The exact fair market value and redemption date may not be set forth in the table above, in which case, if the fair market value is between two values in the table or the redemption date is between two redemption dates in the table, the number of common shares of the Company to be issued for each warrant exercised will be determined by a straight-line interpolation between the number of shares set forth for the higher and lower fair market values and the earlier and later redemption dates, as applicable, based on a 365 or 366-day year, as applicable. For example, if the volume weighted average price of our common shares during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of the warrants is $11.00 per share, and at such time there are 57 months until the expiration of the warrants, holders may choose to, in connection with this redemption feature, exercise their warrants for 0.277 common shares for each whole warrant. For an example where the exact fair market value and redemption date are not as set forth in the table above, if the volume-weighted average price of our common shares during the 10 trading days immediately following the date on which the notice of redemption is sent to the holders of the warrants is $13.50 per share, and at such time there are 38 months until the expiration of the warrants, holders may choose to, in connection with this redemption feature, exercise their warrants for 0.298 common shares of the Company for each whole warrant. In no event will the warrants be exercisable on a cashless basis in connection with this redemption feature for more than 0.361 Company common shares per warrant (subject to adjustment). Finally, as reflected in the table above, if the warrants are out of the money and about to expire, they cannot be exercised on a cashless basis in connection with a redemption by us pursuant to this redemption feature, since they will not be exercisable for any Company common shares.

This redemption feature differs from the typical warrant redemption features used in many other blank check company offerings, which typically only provide for a redemption of warrants for cash (other than the private placement warrants) when the trading price for the Company common shares exceeds $18.00 per share for a specified period of time. This redemption feature is structured to allow for all of the outstanding warrants to be redeemed when the Company common shares are trading at or above $10.00 per public share, which may be at a time when the trading price of our Company common shares is below the exercise price of the warrants. We have established this redemption feature to provide us with the flexibility to redeem the warrants without the warrants having to reach the $18.00 per share threshold set forth above under “ Redemption of warrants when the price per common share equals or exceeds $18.00.” Holders choosing to exercise their warrants in connection with a redemption pursuant to this feature will, in effect, receive a number of shares for their warrants based on an option pricing model with a fixed volatility input as of the date of this prospectus. This redemption right provides us with an additional mechanism by which to redeem all of the outstanding warrants, and therefore have certainty as to our capital structure as the warrants would no longer be outstanding and would have been exercised or redeemed. We will be required to pay the applicable redemption price to warrant holders if we choose to exercise this redemption right and it will allow us to quickly proceed with a redemption of the warrants if we determine it is in our best interest to do so. As such, we would redeem the warrants in this manner when we believe it is in our best interest to update our capital structure to remove the warrants and pay the redemption price to the warrant holders.

As stated above, we can redeem the warrants when the Company’s common shares are trading at a price starting at $10.00, which is below the exercise price of $11.50, because it will provide certainty with respect to our capital structure and cash position while providing warrant holders with the opportunity to exercise their warrants on a cashless basis for the applicable number of shares. If we choose to redeem the warrants when the Company’s common shares are trading at a price below the exercise price of the warrants, this could result in the warrant holders receiving fewer Company common shares than they would have received if they had chosen to wait to exercise their warrants for Company common shares if and when such common shares were trading at a price higher than the exercise price of $11.50.

No fractional Company common shares will be issued upon exercise. If, upon exercise, a holder would be entitled to receive a fractional interest in a share, we will round down to the nearest whole number the number of Company common shares to be issued to the holder. If, at the time of redemption, the warrants are exercisable for a security other than the Company common shares pursuant to the Warrant Agreement, the warrants may be exercised for such security.

Redemption Procedures.

A holder of a warrant may notify us in writing in the event it elects to be subject to a requirement that such holder will not have the right to exercise such warrant, to the extent that after giving effect to such exercise, such person (together with such person’s affiliates), to the warrant agent’s actual knowledge, would beneficially own in excess of 4.9% or 9.8% (as specified by the holder) of the Company common shares outstanding immediately after giving effect to such exercise.

Anti-dilution Adjustments.

If the number of outstanding Company common shares is increased by a share capitalization payable in Company common shares, or by a sub-division of ordinary shares or other similar event, then, on the effective date of such share capitalization, sub-division or similar event, the number of Company common shares issuable on exercise of each warrant will be increased in proportion to such increase in the outstanding common shares. A rights offering made to all or substantially all holders of common shares entitling holders to purchase Company common shares at a price less than the fair market value will be deemed a share capitalization of a number of Company common shares equal to the product of (i) the number of Company common shares actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for Company common shares) and (ii) one minus the quotient of (x) the price per Company common share paid in such rights offering and (y) the fair market value. For these purposes, (i) if the rights offering is for securities convertible into or exercisable for Company common shares, in determining the price payable for Company common shares, there will be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) fair market value means the volume weighted average price of Company common shares as reported during the 10 trading day period ending on the trading day prior to the first date on which the Company common shares trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights.

In addition, if we, at any time while the warrants are outstanding and unexpired, pay a dividend or make a distribution in cash, securities or other assets to the holders of all or substantially all Company common shares on account of such Company common shares (or other securities into which the warrants are convertible), other than (a)

as described above or (b) certain ordinary cash dividends, then the warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount of cash and/or the fair market value of any securities or other assets paid on each Company common share in respect of such event.

If the number of outstanding Company common shares is decreased by a consolidation, combination, reverse share sub-division or reclassification of Company common shares or other similar event, then, on the effective date of such consolidation, combination, reverse share sub-division, reclassification or similar event, the number of Company common shares issuable on exercise of each warrant will be decreased in proportion to such decrease in outstanding Company common shares.

Whenever the number of Company common shares purchasable upon the exercise of the warrants is adjusted, as described above, the warrant exercise price will be adjusted by multiplying the warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be the number of Company common shares purchasable upon the exercise of the warrants immediately prior to such adjustment, and (y) the denominator of which will be the number of Company common shares so purchasable immediately thereafter.

In case of any reclassification or reorganization of the outstanding Company common shares (other than those described above or that solely affects the par value of such Company common shares), or in the case of any merger or consolidation of us with or into another corporation (other than a consolidation or merger in which we are the continuing corporation and that does not result in any reclassification or reorganization of our issued and outstanding Company common shares), or in the case of any sale or conveyance to another corporation or entity of the assets or other property of us as an entirety or substantially as an entirety in connection with which we are dissolved, the holders of the warrants will thereafter have the right to purchase and receive, upon the basis and upon the terms and conditions specified in the warrants and in lieu of the Company common shares immediately theretofore purchasable and receivable upon the exercise of the rights represented thereby, the kind and amount of Company common shares or other securities or property (including cash) receivable upon such reclassification, reorganization, merger or consolidation, or upon a dissolution following any such sale or transfer, that the holder of the warrants would have received if such holder had exercised their warrants immediately prior to such event. If less than 70% of the consideration receivable by the holders of Company common shares in such a transaction is payable in the form of Company common shares in the successor entity that is listed for trading on a national securities exchange or is quoted in an established over-the-counter market, or is to be so listed for trading or quoted immediately following such event, and if the registered holder of the warrant properly exercises the warrant within thirty days following public disclosure of such transaction, the warrant exercise price will be reduced as specified in the Warrant Agreement based on the Black-Scholes Warrant Value (as defined in the Warrant Agreement) of the warrant. The purpose of such exercise price reduction is to provide additional value to holders of the warrants when an extraordinary transaction occurs during the exercise period of the warrants pursuant to which the holders of the warrants otherwise do not receive the full potential value of the warrants.

The Warrant Agreement provides that the terms of the warrants may be amended without the consent of any holder for the purpose of (i) curing any ambiguity or correcting any defective provision or mistake, including to conform the provisions of the Warrant Agreement to the description of the terms of the warrants and the Warrant Agreement set forth in this prospectus, (ii) adjusting the provisions relating to cash dividends on common shares as contemplated by and in accordance with the Warrant Agreement or (iii) adding or changing any provisions with respect to matters or questions arising under the Warrant Agreement as the parties to the Warrant Agreement may deem necessary or desirable and that the parties deem to not adversely affect the rights of the registered holders of the warrants, provided that the approval by the holders of at least 50% of the then-outstanding public warrants is required to make any change that adversely affects the interests of the registered holders of public warrants, and, solely with respect to any amendment to the terms of the private placement warrants, 50% of the then outstanding private placement warrants. You should review a copy of the Warrant Agreement.

The warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number of warrants being exercised. The warrant holders do not have the rights or privileges of holders of ordinary shares and any voting rights until they exercise their warrants and receive Company common shares. After the issuance Company common shares upon exercise of the warrants, each holder will be entitled to one vote for each share held of record on all matters to be voted on by shareholders.

Private Placement Warrants

The private placement warrants (including the Company common shares issuable upon exercise of such warrants) will not be redeemable by us so long as they are held by ION Holdings 2, LP (the “Sponsor), members of the Sponsor or their permitted transferees. The Sponsor or its permitted transferees, have the option to exercise the

private placement warrants on a cashless basis. Except as described below, the private placement warrants have terms and provisions that are identical to those of the public warrants. If the private placement warrants are held by holders other than the Sponsor or its permitted transferees, the private placement warrants will be redeemable by us and exercisable by the holders on the same basis as the warrants included in the units being sold in this offering.

If holders of the private placement warrants elect to exercise them on a cashless basis, they would pay the exercise price by surrendering his, her or its warrants for that number of Company common shares equal to the quotient obtained by dividing (x) the product of the number of Company common shares underlying the warrants, multiplied by the excess of the “fair market value” of the Company common shares (defined below) over the exercise price of the warrants by (y) the fair market value. The “fair market value” will mean the average reported closing price of the Company common shares for the 10 trading days ending on the third trading day prior to the date on which the notice of warrant exercise is sent to the warrant agent.

Dividends

The payment of future dividends on the shares of our common stock will depend on the financial condition of the Company and be subject to the discretion of the Board. There can be no guarantee that cash dividends will be declared. The ability of the Company to declare dividends may be limited by the terms and conditions of other financing and other agreements entered into by the Company or any of its subsidiaries from time to time.

In addition, Innovid is generally prohibited under Delaware law from making a distribution to a shareholder to the extent that, at the time of the distribution, after giving effect to the distribution, liabilities of Innovid (with certain exceptions) exceed the fair value of its assets. Subsidiaries of Innovid are generally subject to similar legal limitations on their ability to make distributions to Innovid.

Anti-Takeover Effects of the Certificate of Incorporation, the Bylaws and Certain Provisions of Delaware Law

The Certificate of Incorporation, the Bylaws and the DGCL contain provisions, which are summarized in the following paragraphs, that are intended to enhance the likelihood of continuity and stability in the composition of the Board and to discourage certain types of transactions that may involve an actual or threatened acquisition of the Company. These provisions are intended to avoid costly takeover battles, reduce the Company’s vulnerability to a hostile change of control or other unsolicited acquisition proposal, and enhance the ability of the Board to maximize stockholder value in connection with any unsolicited offer to acquire the Company. However, these provisions may have the effect of delaying, deterring or preventing a merger or acquisition of the Company by means of a tender offer, a proxy contest or other takeover attempt that a stockholder might consider in its best interest, including attempts that might result in a premium over the prevailing market price for the shares of our common stock. The Certificate of Incorporation provides that any action required or permitted to be taken by the Company’s stockholders must be effected at a duly called annual or extraordinary general meeting of such stockholders and may not be effected by any consent in writing by such holders except that any action required or permitted to be taken by holders of our preferred stock, voting separately as a series or separately as a class with one or more other such series, may be taken without a meeting, without prior notice and without a vote, if a consent or consents, setting forth the action so taken, are signed by the holders of outstanding shares of the relevant class or series having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and are delivered to the Corporation in the manner forth in Section 228 of the DGCL.

Authorized but Unissued Capital Stock

Delaware law does not require stockholder approval for any issuance of authorized shares. However, the listing requirements of the New York Stock Exchange (the “NYSE”), which would apply if and so long as our common stock remains listed on NYSE, require stockholder approval of certain issuances equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of our common stock. Additional shares that may be issued in the future may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions.

One of the effects of the existence of unissued and unreserved common stock may be to enable the Board to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise and thereby protect the continuity of management and possibly deprive stockholders of opportunities to sell their shares of our common stock at prices higher than prevailing market prices.

Election of Directors and Vacancies

The Certificate of Incorporation provides that the Board will determine the number of directors who will service on the board. The exact number of directors will be fixed from time to time by a majority of the Board. The Certificate of Incorporation provides that the Board will be divided into three classes designated as Class I, Class II and Class III. Class I directors will initially serve for a term expiring at the first annual meeting of stockholders following the Closing. Class II and Class III directors will initially serve for a term expiring at the second and third annual meeting of stockholders following the Closing, respectively. At each succeeding annual meeting of stockholders, directors will be elected for a full term of three years to succeed the directors of the class whose terms expire at such annual meeting of the stockholders. There is no limit on the number of terms a director may serve on the Board.

In addition, the Certificate of Incorporation provides that any vacancy on the Board, including a vacancy that results from an increase in the number of directors or a vacancy that results from the removal of a director with cause, may be filled only by a majority of the directors then in office, subject to any rights of the holders of our preferred stock.

Quorum

The Bylaws provide that at any meeting of the Board, a majority of the total number of directors then in office constitutes a quorum for the transaction of business.

No Cumulative Voting

Under Delaware law, the right to vote cumulatively does not exist unless the Certificate of Incorporation expressly authorizes cumulative voting. The Certificate of Incorporation does not authorize cumulative voting.

General Stockholder Meetings

The Certificate of Incorporation provides that special meetings of stockholders may be called only by or at the direction of the Board, the Chairman of the Board or the Chief Executive Officer.

Requirements for Advance Notification of Stockholder Meetings, Nominations and Proposals

The Bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the Board or a committee of the Board. For any matter to be “properly brought” before a meeting, a stockholder will have to comply with advance notice requirements and provide the Company with certain information. Generally, to be timely, a stockholder’s notice must be received at the Company’s principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the immediately preceding annual meeting of stockholders (for the purposes of the first annual meeting of the stockholders of the Company following the adoption of the Bylaws, the date of the preceding annual meeting will be deemed to be June 8, 2021). The Bylaws allow the Board to adopt rules and regulations for the conduct of a meeting of the stockholders as it deems appropriate, which may have the effect of precluding the conduct of certain business at a meeting if the rules and regulations are not followed. These provisions may also defer, delay or discourage a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to influence or obtain control of the Company.

Supermajority Provisions

The Certificate of Incorporation and the Bylaws provide that the Board is expressly authorized to make, alter, amend, change, add to, rescind or repeal, in whole or in part, the Bylaws without a stockholder vote in any matter not inconsistent with the laws of the State of Delaware or the Certificate of Incorporation.

The DGCL provides generally that the affirmative vote of a majority of the outstanding shares entitled to vote thereon, voting together as a single class, is required to amend a corporation’s Certificate of Incorporation, unless the Certificate of Incorporation requires a greater percentage. The Certificate of Incorporation provides that the following provisions therein may be amended, altered, repealed or rescinded only by the affirmative vote of the holders of a majority of at least 66 2/3% in voting power all the then outstanding shares of the Company’s stock entitled to vote thereon, voting together as a single class:

•the provision regarding the Board being authorized to amend the Bylaws without a stockholder vote;

•the provisions providing for a classified Board (the election and term of directors);

•the provisions regarding filling vacancies on the Board and newly created directorships;

•the provisions regarding resignation and removal of directors;

•the provisions regarding calling special meetings of stockholders;

•the provisions regarding stockholder action by written consent;

•the provisions eliminating monetary damages for breaches of fiduciary duty by a director;

•the provisions regarding competition and corporate opportunities;

•the provisions regarding exclusivity of forum; and

•the amendment provision requiring that the above provisions be amended only with a 66 2/3% supermajority vote.

These provisions may have the effect of deterring hostile takeovers or delaying or preventing changes in control of the Company or its management, such as a merger, reorganization or tender offer. These provisions are intended to enhance the likelihood of continued stability in the composition of the Board and its policies and to discourage certain types of transactions that may involve an actual or threatened acquisition of the Company. These provisions are designed to reduce the Company’s vulnerability to an unsolicited acquisition proposal. The provisions are also intended to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others from making tender offers for our common stock and, as a consequence, may inhibit fluctuations in the market price of our common stock that could result from actual or rumored takeover attempts. Such provisions may also have the effect of preventing changes in management.

Exclusive Forum

The Certificate of Incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware, or if such court does not have subject matter jurisdiction, any other court located in the State of Delaware with subject matter jurisdiction, will be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, other employee or stockholder of the Company to the Company or the Company’s stockholders, (iii) any action asserting a claim against the Company or any director or officer of the Company (a) arising pursuant to any provision of the DGCL or the Certificate of Incorporation or the Bylaws or (b) as to which the DGCL confers jurisdiction on the Court of Chancery of the State of Delaware or (iv) any action to interpret, apply, enforce or determine the validity of the Certificate of Incorporation or the Bylaws or any of their provisions, (v) any action asserting a claim against the Company or any current or former director, officer, employee, stockholder or agent of the Company governed by the internal affairs doctrine of the law of the State of Delaware, or (vi) any action asserting an “internal corporate claim” as defined in Section 115 of the DGCL. To the fullest extent permitted by law, any person or entity purchasing or otherwise acquiring or holding any interest in shares of capital stock of the Company will be deemed to have notice of and consented to the forum provisions in the Certificate of Incorporation. However, it is possible that a court could find the Company’s forum selection provisions to be inapplicable or unenforceable. Although the Company believes this provision benefits it by providing increased consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against Company’s directors and officers. For example, under the Securities Act, federal courts have concurrent jurisdiction over all suits brought to enforce any duty or liability created by the Securities Act, and investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder. In addition, the exclusive forum provisions described above do not apply to any actions brought under the Exchange Act or any other claims for which United States federal courts have exclusive jurisdiction.

Conflicts of Interest

Delaware law permits corporations to adopt provisions renouncing any interest or expectancy in certain opportunities that are presented to the corporation or its officers, directors or stockholders. The Certificate of Incorporation, to the maximum extent permitted from time to time by Delaware law, renounces any interest or expectancy that the Company has in, or right to be offered an opportunity to participate in, specified business opportunities that are from time to time presented to directors, principals, officers, employees, equityholders and

other representatives of Sponsor, or the Company’s non-employee directors or his or her affiliates. The Certificate of Incorporation also provides that, to the fullest extent permitted by law, none of directors, principals, officers, employees, equityholders and other representatives of Sponsor and Innovid or the Company’s non-employee directors or his or her affiliates will have any duty to refrain from (i) engaging in a corporate opportunity in the same or similar lines of business in which the Company or its affiliates will engage or propose to engage or (ii) otherwise competing with the Company or its affiliates. In addition, to the fullest extent permitted by law, in the event that directors, principals, officers, employees, equityholders and other representatives of Sponsor and Innovid or any of the Company’s non-employee director or any of his or her affiliates acquires knowledge of a potential transaction or other business opportunity which may be a corporate opportunity for itself or himself or herself and the Company or its affiliates or stockholders, will not be liable to the Company or its stockholders or to any affiliates of the Company for breach of any duty as a stockholder, director or officer of the Company solely by reason of the fact that such person pursues or acquires such corporate opportunity of itself, himself or herself, or offers or directs such corporate opportunity to another person or does not present such corporate opportunity to the Company or any of its affiliates or stockholders. The Certificate of Incorporation does not renounce the Company’s interest in any business opportunity that is expressly offered to a non-employee director solely in his or her capacity as a director or officer of the Company. No business opportunity will be deemed to be a potential corporate opportunity for the Company unless (x) it would be permitted to undertake the opportunity, financially, legally and contractually, (y) the opportunity would be in line with the Company’s business or (z) the opportunity is one in which the Company has interest or reasonable expectancy.

Limitations on Liability and Indemnification of Officers and Directors

The DGCL authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties, subject to certain exceptions. The Certificate of Incorporation includes a provision that eliminates the personal liability of directors for monetary damages for any breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL. The effect of these provisions is to eliminate the rights of the Company and its stockholders, through stockholders’ derivative suits on the Company’s behalf, to recover monetary damages from a director for breach of fiduciary duty as a director, including breaches resulting from grossly negligent behavior. However, exculpation does not apply to any director if the director has acted in bad faith, knowingly or intentionally violated the law, authorized illegal dividends or Redemptions or derived an improper benefit from his or her actions as a director.

The Bylaws provide that the Company must indemnify and advance expenses to directors and officers to the fullest extent authorized by the DGCL. The Company is also expressly authorized to carry directors’ and officers’ liability insurance providing indemnification for directors, officers and certain employees for some liabilities. The Company believes that these indemnification and advancement provisions and insurance are useful to attract and retain qualified directors and executive officers.

The limitation of liability, indemnification and advancement provisions in the Certificate of Incorporation and the Bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions also may have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit the Company and its stockholders. In addition, your investment may be adversely affected to the extent the Company pays the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions. The Company believes that these provisions, liability insurance and any indemnity agreements that may be entered into are necessary to attract and retain talented and experienced directors and officers.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to the Company’s directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

There is currently no pending material litigation or proceeding involving any of the Innovid’s respective directors, officers or employees for which indemnification is sought.

Investor Registration Rights

The Company has entered into an Investor Rights Agreement, a form of which is incorporated by reference in this prospectus with ION and the other Innovid Equity Holders and the holders of the Founder Shares, Private Placement Warrants and warrants issued upon conversion of working capital loans (if any) pursuant to which such parties will have specified rights to require the Company to register all or a portion of their shares under the Securities Act. This Investor Rights Agreement terminated and replaced the investor rights agreement entered into

by ION with respect to the Founder Shares, Private Placement Warrants and warrants issued upon conversion of working capital loans (if any), at the closing of the ION IPO. In addition, in connection with the PIPE Investment, we agreed to file a registration statement covering the shares purchased by the PIPE Investors.

Transfer Agent and Registrar

The Transfer Agent and registrar for the shares of our common stock is Continental Stock Transfer & Trust Company.

Listing

Our common stock and warrants are listed on the NYSE under the symbols “CTV” and “CTV.WS”, respectively.